Diamond Polishing Pads Import Taxes in Middle East Market

The Middle East market has experienced a significant demand for diamond polishing pads, widely used in various industries like construction, manufacturing, and stone polishing. However, as with any import, these products come with their fair share of taxes and duties that impact both businesses and consumers. Understanding these import taxes is crucial for companies looking to enter or expand their footprint in the Middle Eastern market.

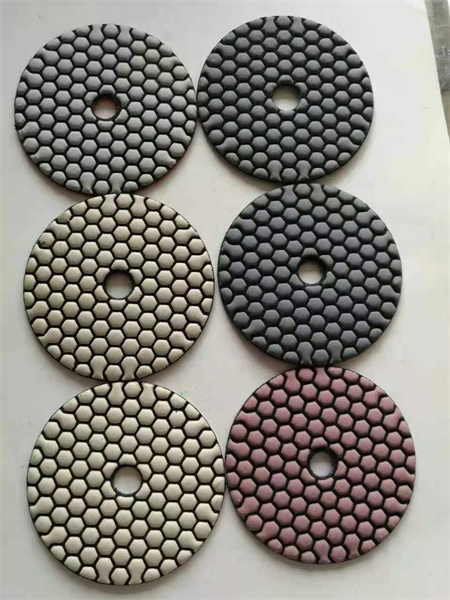

Diamond polishing pads are high-quality tools essential for giving surfaces a smooth, polished finish. While their benefits are undeniable, navigating the tax and duty structure associated with their importation can be tricky. In the Middle East, customs policies vary from country to country, and each has its unique approach to taxing imported goods, including diamond polishing pads. This variation can pose challenges for businesses that are not familiar with the region’s rules.

Countries in the Middle East, like the UAE, Saudi Arabia, and Qatar, impose a standard Value Added Tax (VAT) on most imports, including diamond polishing pads. For example, the UAE applies a 5% VAT, which businesses must account for when importing goods. In addition to VAT, customs duties might also be applicable, though these can vary depending on the product category and the specific trade agreements between the exporting country and the Middle Eastern nation. Typically, these duties range from 5% to 20% but can be higher in some cases.

Another important consideration is the free trade agreements (FTAs) some Middle Eastern countries have with others. These agreements can reduce or eliminate tariffs on certain products, potentially lowering the overall cost of importing diamond polishing pads. Countries like the UAE and Bahrain, for example, benefit from FTAs with countries like the United States and the European Union, which can significantly lower taxes on imports from these regions.

However, businesses should also be aware of non-tariff barriers, such as quality and safety standards. Some Middle Eastern countries require products to meet specific certifications or standards before they can be imported. This can add additional time and costs to the process. In addition, regional trade policies may change due to geopolitical factors, so it’s essential for companies to stay up-to-date on the latest developments.

Navigating these import taxes and regulations is not just about understanding the financial implications but also about anticipating potential delays or obstacles in the supply chain. For companies looking to import diamond polishing pads, partnering with a knowledgeable customs broker or a local agent can help streamline the process and ensure compliance with all applicable regulations.

In conclusion, while importing diamond polishing pads into the Middle Eastern market presents opportunities, it also requires a solid understanding of the region’s tax structure and trade policies. Businesses that do their homework and stay informed about the constantly evolving rules can successfully manage the costs and avoid unpleasant surprises, ensuring their place in this growing market.